News

Reverse charge mechanism for Japanese consumption tax purposes – in case of google

2021.05.12

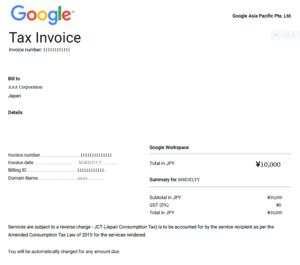

Regarding the reverse charge mechanism for Japanese consumption tax purposes, we picked up this matter previously (https://visionary-tax.com/en/2020/06/06/184/), however, we will look into the example of Google Workspace invoice this time.

Conditions;

A Japanese company uses Google Drive and Google Drive service is being rendered by a Singapore company, Google Asia Pacific Pte, Ltd in Japan.

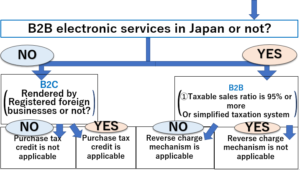

(Note: To became “Registered foreign businesses”, the tax application should be submitted to the Japanese tax authorities.)

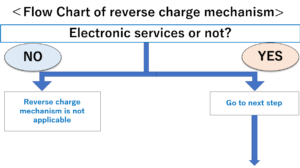

In the above flowchart, this transaction falls under the category of B2B electronic services in Japan. In the case where the taxable sales ratio of the Japanese company for Japanese consumption tax purposes is 95% or more, or the Japanese company applies the simplified taxation system for Japanese consumption tax purposes, the reverse charge mechanism is not applicable and the consumption tax credit cannot be taken. On the other hand, the taxable sales ratio is less than 95%, the reverse charge mechanism is applicable.

There are lots of convenient tools provided by foreign service providers these days, judgement on Japanese consumption tax status has to be done each time.