News

Consumption taxation on cross-border electronic services/”reverse charge system”

2020.06.06

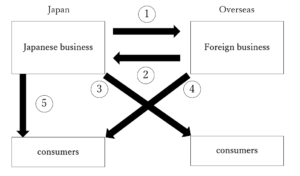

Criterion for determining domestic or foreign transactions regarding cross-border electronic services has been changed from October 1, 2015. Followings are examples of the said electronic services;

●Provision of e-books, digital newspapers, music, videos and software (including applications such as games) via internet

●Services that allow customers to use software and databases in the cloud

●Services that provide customers with storage space to save their electronic data in the cloud

●Distribution of advertisements via internet

●Services that allow customers to access shopping and auction sites on the internet, etc.

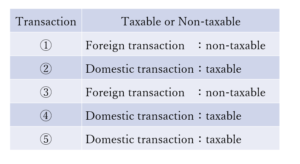

We have considered the Japanese consumption tax treatment of Japanese business (A) selling e-books to Japanese consumers (C) via Amazon (B).

<Recognition of sales>

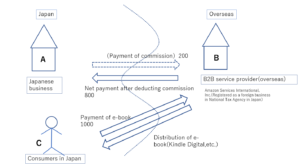

Net sales paid by Amazon to A at 800 should be posted in gross sales at 1000. Since domestic/foreign transaction for consumption tax purposes should be judged based on the address of the service recipients, i.e., Japan in this case, sales should be treated as taxable transaction for consumption tax purposes.

<Commision to be paid to Amazon>

Commission to be paid to Amazon (precisely, Amazon Services International, Inc. which is registered as a foreign business in NTA) is subject to the reverse charge system and the treatment differs depending upon the taxable sales ratio of A.

In the case where the taxable sales ratio of A is 95% or more, commission is treated as non-taxable transaction for consumption tax purposes.

In the case where the taxable sales ratio of A is less than 95%, commission is treated as taxable transaction for consumption tax purposes.

As stated above, Japanese consumption tax treatment is getting more and more complicated, there are errors sometimes found in practice.