News

Fees for technical services in case of India

2021.05.26

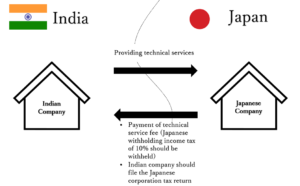

There seems the number of transactions between Japan and India has been increasing these days. The Japanese tax issues should be paid attention to the transaction with India. In the case where the Indian company provide technical services such as consulting, software development, etc. to the Japanese company, how the fees are treated for tax purposes?

<Treatment of Japanese withholding income tax>

Under the Republic of India/Japan tax treaty Article 12.2, it stipulated that fees for technical services may be taxed in the country in which they arise and according to the laws of the country (i.e., Japan in this case). Therefore, fees for technical services rendered by the Indian company and paid by the Japanese company are subject to Japanese withholding income tax. Under the Japanese domestic tax law, withholding income tax rate is 20.42%, however, withholding income tax rate goes down to 10% by submitting the the application form for income tax convention to the Japanese tax authorities.

<Treatment of Japanese corporation tax>

The Indian company will need to file the Japanese corporation tax return due to the unique treatment of India/Japan tax treaty mentioned above. 10% of withholding income tax can be credited against Japanese corporation tax in the tax return.