News

Filing extension of Japanese corporate/consumption tax returns

2021.04.01

From the year ended March 31, 2021, the one month extension of filing the consumption tax return is applicable to the company which has already applied for the extension of corporate tax returns for one month, by submitting the report to extend the consumption tax return to the Japanese tax authorities.

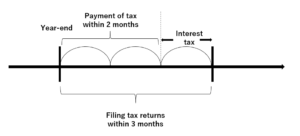

Before this tax reform, a company needs to file the consumption tax return and pay consumption tax/estimated corporate taxes within two months after the year end. The company which applied one month extension of filing the corporate tax returns files the corporate tax returns within three months after the year-end. In the case where figures in local book have been changed after two months from year end, the company had to file the amended consumption tax return.

However, the one month extension of filing the consumption tax return is available, the company can file the consumption tax returns at the same time with filing the corporate tax returns. There is no extension of payment, therefore, consumption/estimated corporate taxes should be made within two months after the year-end and interest will be taxed from the next date of original due date till the payment date.