News

Japanese consumption tax status for newly established corporation

2021.03.16

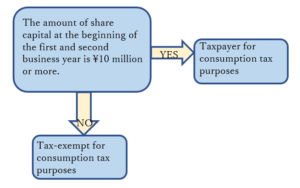

As you may be aware, in the case where the share capital of the newly established corporation is JPY10,000,000 or more at the beginning of the first and second business years after its establishment, Japanese consumption tax is not exempt for that corporation.

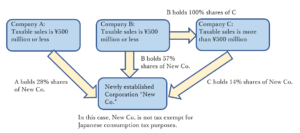

In the case where the newly established corporation (“New Co.”) controlled by the certain shareholder (holds more than 50% of share), and when the taxable sales amount of that controlling shareholder or affiliated corporations of that controlling shareholder is more than 500 million yen, consumption tax is not exempt for New Co.

For example, New Co. falls under the category of taxpayer for Japanese consumption tax purposes in the below case.