News

Thin capitalization rule in Japan

2020.04.16

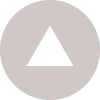

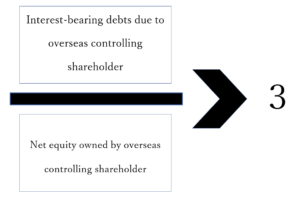

Thin capitalization rule is applicable in Japan if debt-equity ratios under (1) and (2) below are both more than 3.

1. Interest-bearing debts due to overseas controlling shareholder/Net equity owned by overseas controlling shareholder

and

2. Total interest-bearing debts including those due to third parties/Net equity of the company

Then, the amount to be disallowed for tax purposes under thin-capitalization rule is calculated as follows;

Interest paid to overseas controlling shareholder x ((B)-(A)x3)/(B)

(A)=Net equity owned by overseas controlling shareholder

(B)=Interest-bearing debts due to overseas controlling shareholder