News

Notification for Ultimate Parent Entity – BEPS

2019.12.10

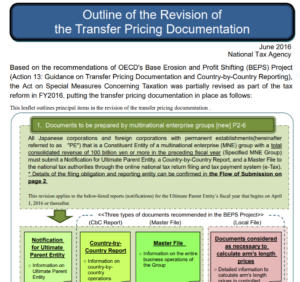

All Japanese corporations and foreign corporations with permanent establishment (“PE”) that is a Constituent Entity of a multinational enterprise (“MNE”) group with a total consolidated revenue of 100 billion yen or more in the preceding fiscal year must submit a Notification for Ultimate Parent Entity by the date when the Ultimate Parent Entity’s fiscal year ends via e-tax to the Japanese tax authorities.