News

Certification of Japanese tax payment

2021.06.21

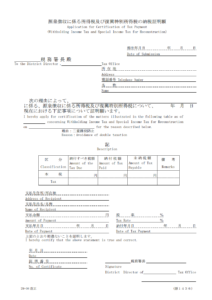

When payments from Japan to non-residents/foreign corporations (“Non-residents”) are subject to Japanese withholding income tax in Japan, Non-residents may need certification of Japanese withholding income tax payment to take foreign tax credit in home countries. In this case, Residents in Japan/Japanese companies which made payments to Non-residents request the Japanese tax authorities to issue the certification of tax payment by submitting the “Application for certification of tax payment (Withholding Income Tax and Special Income Tax for Reconstruction)” as attached.

It normally take one or two weeks for the Japanese tax authorities to issue the certification of tax payment.